Steady Markets and Sideways Swings: A Closer Look at What’s Driving Focus and Stability in an Evolving Market Environment

- Chinmay K

- Jan 2

- 3 min read

As the market transitions through a phase of moderation, it challenges the strength of its underlying fundamentals. Such periods of correction require a thoughtful balance between assessing momentum and managing risk, highlighting the importance of strategic foresight.

In this environment, downside risk protection becomes essential, enabling investors to navigate uncertainties while carefully identifying opportunities for future growth.

India’s macroeconomic resilience and structural growth drivers provide a reassuring foundation of stability. However, the current climate calls for measured expectations and a focused approach to addressing near-term challenges. Below, we delve into the key macroeconomic factors shaping India Inc.'s investment landscape..

Indian Macroeconomy

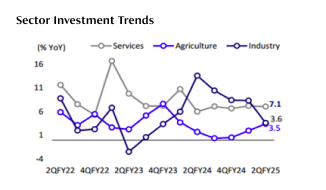

The industrial sector, a significant component of investment, has been underperforming, with growth in manufacturing, mining, and electricity sub-sectors declining. Despite these headwinds, the services sector continues to demonstrate resilience, offsetting the negative impacts of the industrial slowdown.

Private consumption also weakened, registering a growth rate of 5.1% YoY in 2QFY25 compared to 6.3% YoY in 2QFY24. The slowdown in consumer spending is primarily driven by a decline in urban consumption. However, a healthy monsoon this year has sparked signs of recovery in the previously weak rural economy.

In 2QFY25, rural consumption grew by 2.6% YoY, marking its first expansion in five quarters and an improvement from -0.2% in 1QFY25 and -0.5% in 2QFY24. This growth was supported by several positive indicators, including a 0.3% YoY rise in real agricultural wages, reversing four consecutive quarters of decline, while real non-agricultural wages contracted slightly by -0.3% YoY.

Indian Equity

FIIs exhibited a steep net outflow during Q2 FY25, pulling approximately $13 billion out of Indian equities in October and November 2024. However, a secular trend in India is the increasing convergence between FII and DII ownership in listed companies. As of September 2024, FIIs owned 17.8% of Indian equities (down from 19.0% in December 2023), while DII ownership rose to 17.0% (up from 16.8% at the start of the year). This steady rise in domestic participation reflects a significant shift in investor dynamics, with retail and institutional investors playing a more dominant role in recent years.

Domestic equity performance during Q2 FY25 has faced headwinds on the consumption front. Rural consumption trends have shown resilience, but household spending growth remains under stress, compounded by concerns about weak wage growth and rising personal debt. Non-mortgage personal loans, a category of household credit, could escalate challenges for credit markets if consumption trends fail to recover meaningfully. While a few sectors, such as Banking, Financials, and Technology, have emerged as growth drivers, overall consumption remains a critical area of concern.

The Indian economy continues to remain on strong footing, with visible signs of growth getting back on track. We maintain a positive outlook on equity markets from a long-term perspective. However, in the short run, given uncertainties in the global context such as geopolitical upheavals, central bank policies, and rich domestic valuations, Indian equities may face concerns. Therefore, a balanced and optimised strategy focused on long-term quality and short-term downside risk protection has been selected for your portfolio.

Indian Debt

FPI flows into India have been muted over the last three months due to higher US Treasury yields, a stronger dollar, and a reduced differential between US and Indian yields.

When US Treasury yields rise, US government bonds become more attractive to global investors, including FPIs. Investors seeking safer assets with higher returns may move capital out of riskier emerging market assets (like Indian equities) and shift to US government bonds. The higher returns on Treasuries make them more competitive compared to Indian assets, which are perceived as riskier.

As US yields rise, international investors have a greater incentive to allocate a larger share of their portfolios to US bonds rather than emerging market stocks or debt. This results in a pullback in FPI inflows into India and other emerging markets.

However, debt instruments continue to balance the risk exposure in your equity complement, providing sufficient downside risk protection. Therefore, your portfolio incorporates a hybrid fund with a focus on a high proportion of equity and debt, ensuring a balanced strategy.

Comments